Vigilante

Adobe Stock_1239557393

Vive La Bond Vigilantes!

(Long Live the Bond Vigilantes!)

By Brian Broberg | April 24th, 2025

vig∙i∙lan∙te

noun

a member of a self-appointed group of citizens who undertake law enforcement in their community without legal authority, typically because the legal agencies are thought to be inadequate.

Bond investors are the economy’s bond vigilantes. … So, if the fiscal and monetary authorities won’t regulate the economy, the bond investors will. The economy will be run by vigilantes in the credit markets.

–Dr. Ed Yardeni, economist, 1983

Vigilante

Adobe Stock_1239557393

Who are these Crusaders and what did they do? They are influential, deep-pocketed investors in the bond market, and are well known for their ability to sway governments. They move interest rates by buying or selling bonds in massive quantities. Their intent is to send signals to the authorities, especially when certain leaders are not listening. More on that thought in a bit.

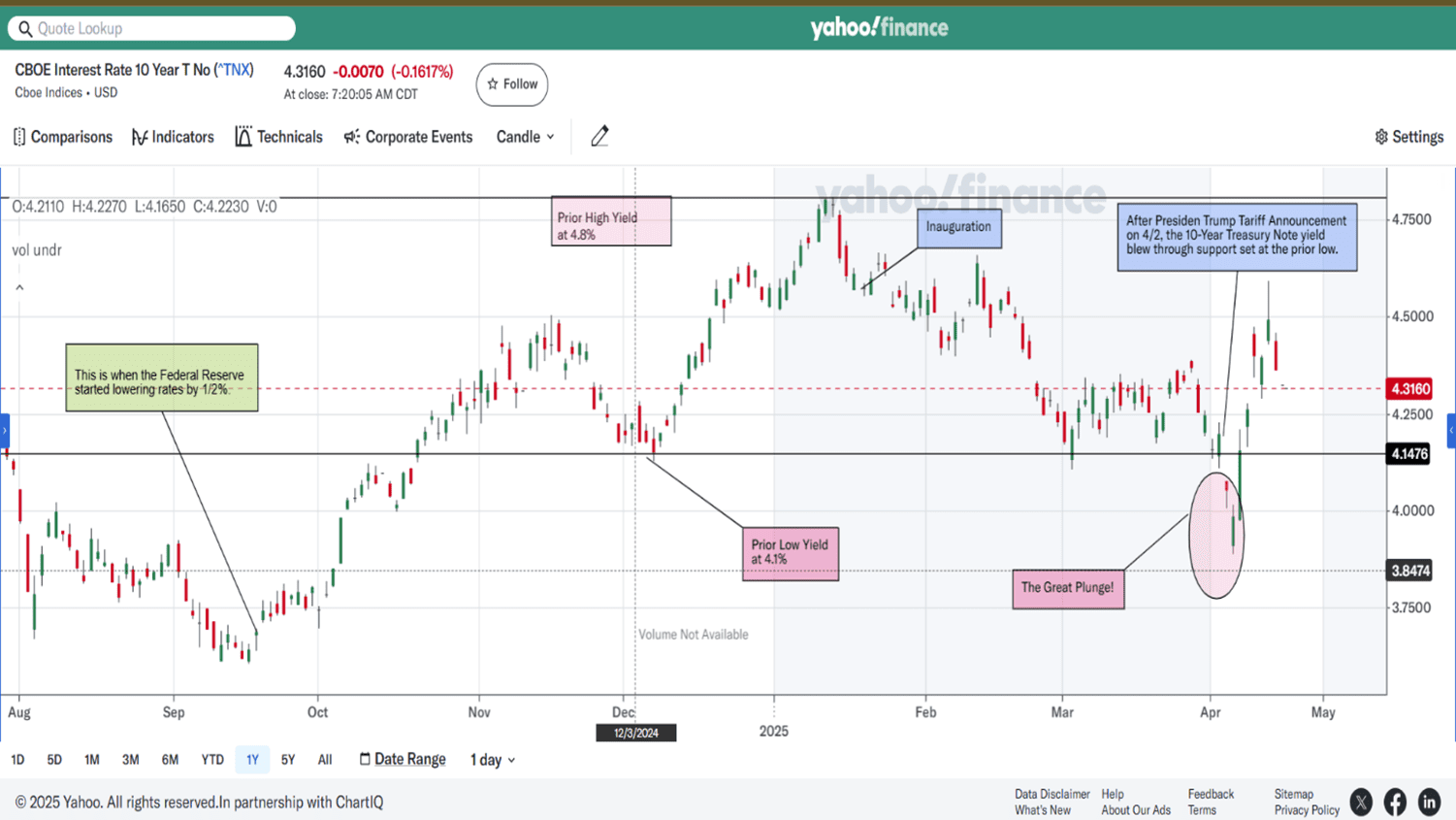

For some context, though, let’s review the chart below. It shows the direction of interest rates/yields for the 10-year US Treasury bond for the last nine months. Going back to September, yields rose quickly after the Federal Reserve (the Fed) started lowering short-term rates. The move upward in these longer-term rates from this time to early January was the exact opposite of what most investors expected. So why did it happen?

10-Year US Treasury Bond Yield for Past Nine Months

The chart also shows that these same Treasury yields peaked at 4.8% in January. The peak is represented by the top black horizontal line, which is the high point for the trading range since the New Year. The lower black line represents the low end of the trading range, at 4.1%. After the sell-off in bonds that led to the peak, the same bond traders turned their attention to the much-publicized tariff policy of the incoming Trump Administration. They saw the risks of a new broad and sweeping tariff plan and were concerned about their potential effect. That is, a slowing economy. The Vigilantes sought safety and bought Treasuries, driving bond prices higher and yields lower. In this case, they sent a clear message to the president. They were convinced that if the Administration wasn’t careful, the tariff regime would not only slow the economy but cause a recession. Like a poker table, they bet their own money on it, and their wager doubled as a warning. The only question was, “Who was going to blink?”

As if to defy the market, and after it closed on April 2nd, the president’s “tariffying” announcement came. The magnitude of the tariffs was beyond what anyone expected. The next morning, it was like a shootout at the OK Corral. The president and his men were on one side and the Bond Vigilantes on the other. The next morning, bond yields plunged (labeled “The Great Plunge” on the chart) through the lower end of the range. The next day, April 4th, the Vigilantes confirmed their actions by pushing yields even further, below 4%. It was a big move, and the buying of Treasuries was frenetic. This was coupled with a major sell-off in the stock market. Even bystanders were shooting anything that moved!

The real story is that most everyday Americans had no idea how close the country came to a credit crisis. Even Jamie Dimon, CEO of JP Morgan, warned that the US financial plumbing was starting to show signs of distress. What kind of distress? If you remember the Great Financial Crisis back in 2008 after Lehman Brothers went bust, then you’ll get a sense of where things were heading on Friday, April 4th. The Bond Watchmen were at “DEFCON 1,” the highest state for defensive readiness, until…

On the morning of April 9th, the president was briefed on this brewing crisis. To his credit, he did not hesitate and announced a 90-day delay for enforcement of the tariff regime. In two words, he blinked. The stock market was clearly relieved and recorded one of the biggest moves to the upside in history. The reality is that President Trump had to back off of his plan. Since that day and almost daily, more tariff concessions have been announced. And there’s no other way to say it: it’s a slow-walking back of the whole plan, all the while warning of the plan’s imminent return. Yes, he is completely unpredictable. But we should remember that it is not what he says that’s important. It’s rather what he does that matters. Despite the merits of a tariff regime, he was too aggressive, and he realized it. So, we’ll see what comes in ninety days (July 9th).

In the meantime, the Bond Vigilantes fought for truth, justice, and the American way… and let’s not forget—to make a lot of money trading bonds. In the end, though, there is no politician, no matter how much power he thinks he has, that can go against the wishes of these Guardians.

We all watch as President Trump tests the limits of his power. That’s the way he does business and it’s nothing new. But now we know, and more importantly, he knows the limits of his economic power. The Bond Vigilantes showed him, and he responded. That’s a good thing.

Overall, this episode is a mixed bag. Volatility in the markets is still a bit elevated, but a crisis was averted. And for now, the Bond Vigilantes have holstered their Colt Single Action, six-shooting “Peacemakers” and yields are quickly back into the prior trading range. They’ve mounted their horses and are trotting them toward the sunset.

But if the White House gets “Wiley Coyote” again, the Vigilantes will race into town, but this time, with guns ablazing. Yeehaw!